While you could use a credit repair company to help fix your credit, there are many different ways you can improve your credit score on your own. It isn’t going to happen overnight, but with time and the right credit practices, you should see your score improve. Not sure how to go about fixing your credit? Keep reading to find out.

4 Ways to Fix Your Credit Score

If you aren’t sure where to begin your credit repair journey, consider these four actions that can make a positive impact on your credit score over time:

Fix any errors on your credit reports – You should know what’s listed on your credit reports. You’re entitled to a free copy of each of your credit reports every 12 months from the three major credit bureaus: Equifax, Experian, and TransUnion. These can be requested by visiting www.annualcreditreport.com. Look over the information, and if anything is inaccurate, you should dispute the error(s) to the reporting credit bureau(s) immediately.

Fix any errors on your credit reports – You should know what’s listed on your credit reports. You’re entitled to a free copy of each of your credit reports every 12 months from the three major credit bureaus: Equifax, Experian, and TransUnion. These can be requested by visiting www.annualcreditreport.com. Look over the information, and if anything is inaccurate, you should dispute the error(s) to the reporting credit bureau(s) immediately.- Pay all bills on time – Your payment history makes up 35 percent of your FICO credit score, the most common scoring model used by lenders. The more bills that are paid on time each month, the better your score should be.

- Pay down credit card balances – If you use too much of your available credit on your credit cards, it actually lowers your score. A good rule of thumb is to use no more than 30 percent of your total credit limits.

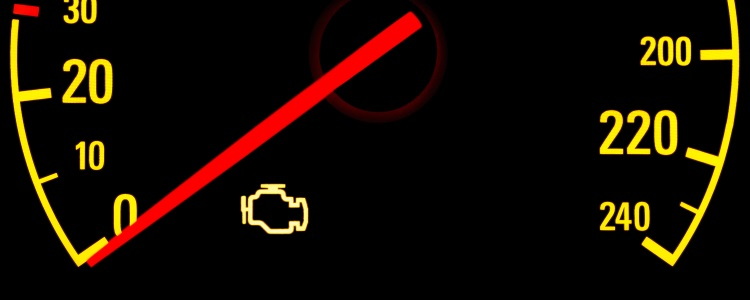

- Apply for new credit – This may seem counterintuitive, but adding an additional line or two of credit could actually help your credit score. This can be in the form of revolving credit (credit cards) or installment credit (mortgages and car loans). The better the credit mix you have, the higher your credit score is likely to be.

How an Auto Loan Can Help

Did you know that applying for an auto loan could actually help you fix and build your credit? It can, but the key is to make sure you’re able to handle a car loan, and can pay it on time each month. When you take out a bad credit auto loan, it gives you a chance to improve your credit, while also getting you the vehicle you need.

Not all lenders offer bad credit financing. You typically have to look for subprime lenders who work with special finance dealerships or buy here pay here dealers. Both offer bad credit financing, and both typically require a certain amount of monthly income and a down payment.

Subprime lenders require you to meet additional qualifications, as well, such as proof of residency and a working landline or contract phone in your name. They also check your credit, whereas buy here pay here dealerships, for the most part, just check if you can financially handle a car payment.

Need Help Locating a Dealership?

Just because you have bad credit doesn’t mean you’re disqualified for auto financing. There are many lenders that work with bad credit car buyers, but finding them isn’t always easy. If you’re stuck in your search for a dealer, we’ve got you covered.

At Drivers Lane, we work with a nationwide network of dealerships that have bad credit lending resources available. Fill out our free and easy auto loan request form, and we’ll get right to work connecting you to a dealer near you.