A recent study from MagnifyMoney and VantageScore uncovered the importance of your credit utilization. After your payment history, your credit utilization is the factor that impacts your credit score the most.

Credit utilization refers to how much of your available credit you are using. To find it, you simply divide your balance on each credit card by its credit limit. This measure is calculated individually for each credit card you have, as well as overall across all credit cards.

Here is an example for a person with two credit cards. One has a credit limit of $2,000, and the balance is currently $400. The utilization rate on that account would be 20% (400 divided by 2,000). The second card has a limit of $4,000, and the balance is $1,500, netting a utilization rate of 37.5%. Overall, this person has total balances of $1,900 and a total credit limit of $6,000. His total utilization rate would be 31.66% (1,900 divided by 6,000).

Now that we understand how it works, let's look at what the study uncovered about credit utilization.

The Study's Findings

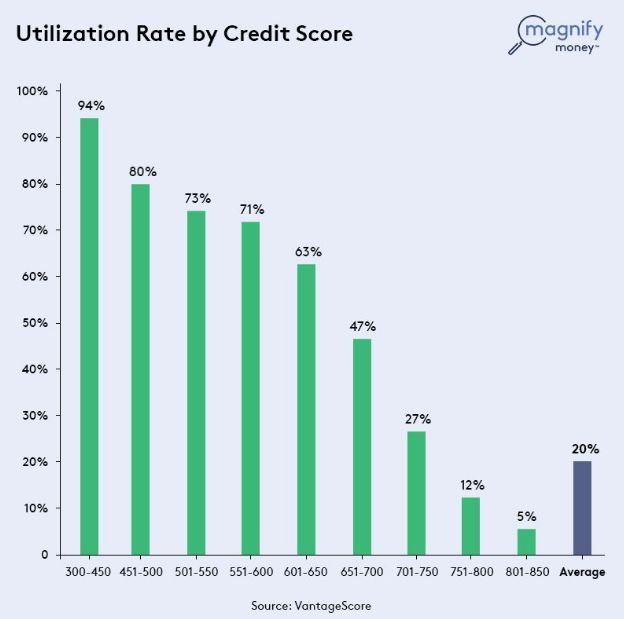

MagnifyMoney teamed up with VantageScore to show consumers how credit utilization impacts their credit scores. This graph says it all.

Note that the study is using the VantageScore 3.0 model when discussing credit scores.

As you can see, people with amazing credit scores at 800 and above had their utilization down to 5% on average. People with great credit (751-800 scores) were at 12%. Meanwhile, you truly see the impact utilization has on your rating when you get to the credit scores in the 650 to 750 range.

Consumers with credit scores ranging from 701-750, which most lenders would classify as "good," had an average utilization rate of 27%. However, consumers with scores closer to "average" by most measures (651-700 range) had an average utilization of 47%. That's a huge gap between good and average.

Taking that one step further, average utilization for consumers with credit scores of 601-650, typically considered below average or even "poor" by some standards, was at 63%.

Clearly, the study shows that utilization plays a big role in shaping your credit. People with great to excellent credit were barely using their credit cards. Meanwhile, the study showed that the difference between an "average" credit score and a "good" one was a whopping 20% in utilization. This indicates that the key to a good credit score is getting your utilization rate under control.

Earning a Better Credit Score

If you are interested in improving your credit score, you're going to want to pay close attention to the findings of this study. Here are some tips if you want to harness the power of credit utilization to earn a higher credit score.

- Get Your Utilization Under 30%. Most experts agree that your utilization starts to negatively affect your credit score when it tops 30%. The results of the study bear that out. So, you're going to want to keep your overall rate, and the balance on each credit card you have, below this mark. Work on paying down high credit card balances at a pace that works for you to achieve this goal.

- Want Great Credit? Aim for 12% and Lower. According to the study, people with great credit scores (above 750) have an average utilization of 12%. If your goal is to earn a great credit score, that is the number you want to aim for. Better yet, go for gold and work on eliminating your balances altogether. Contrary to popular belief, you do not need to carry a balance on your credit cards to improve your credit score.

- Get a Limit Increase. If you feel that your credit limit is simply too low, you can always call and ask for a higher limit. Or, you could apply for a new credit card. Doing this to improve your utilization rate can be a smart financial move, but doing this to support unhealthy credit card habits is trouble, so be careful.

The Bottom Line

A good credit score makes it easy to get approved for loans and lines of credit at the lowest rates. Work on getting your credit utilization under control if you want to improve your credit standing.

Sometimes, you need a car and can't wait months until your credit has improved. Luckily, Drivers Lane helps people dealing with credit issues find car loans in their local area.

Our service is free and doesn't put you under any obligation to buy anything, so you have nothing to lose. Get started by completing our simple and secure car loan request form today.